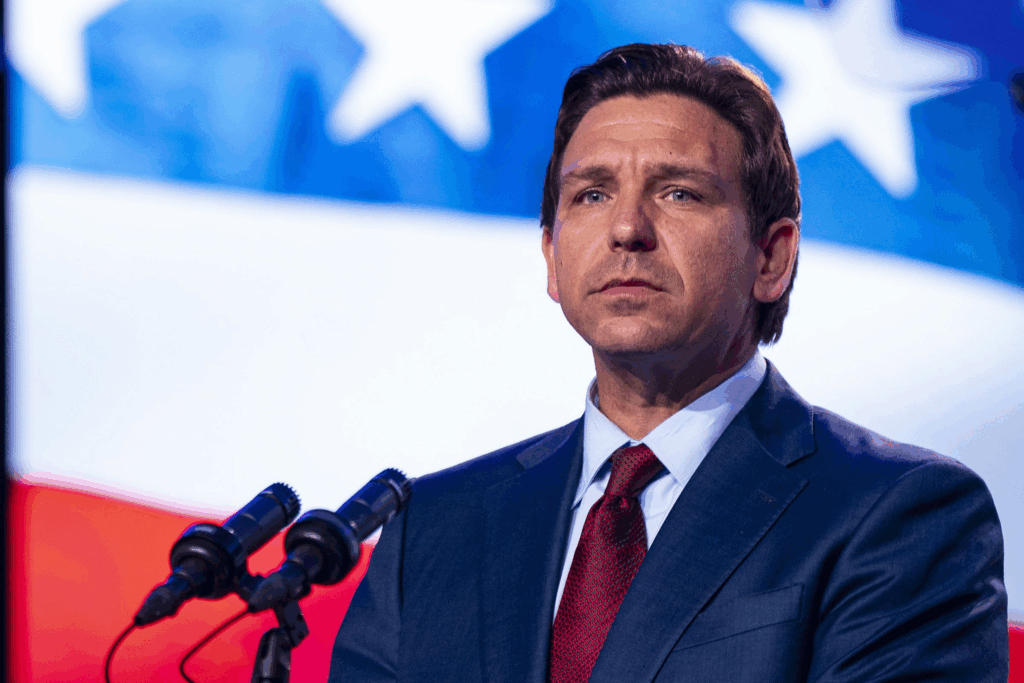

Ron DeSantis and Florida’s Gambling Revolution: The Sports Betting Monopoly Model

Florida Governor Ron DeSantis has emerged as one of America’s most consequential figures in shaping sports betting policy, having orchestrated a controversial 30-year gambling compact with the Seminole Tribe that fundamentally restructured Florida’s gambling industry. As a leading Republican presidential contender and potential 2028 candidate, DeSantis’s approach to gambling regulation, betting industry consolidation, and sports wagering legalization offers crucial insights into how conservative governors are navigating the tension between economic opportunity, tribal sovereignty, and market competition. His decision to create a state-wide monopoly for sports bets represents one of the most distinctive approaches to legal sports bets in America, generating both praise and criticism from across the political spectrum. For those examining how conservative leadership intersects with policies and market dynamics, dedicated pages like UK Political Betting offer valuable perspectives on parallel political wagering trends from the UK.

The 2021 Gambling Compact: A Transformative Deal

In April 2021, Governor DeSantis negotiated and signed a historic 30-year gaming compact with Seminole Tribe Chairman Marcellus Osceola Jr. The agreement fundamentally transformed Florida’s gambling landscape, granting the Seminole Tribe exclusive control over online sports betting throughout the state while permitting them to add craps and roulette to their casino operations. In exchange, the tribe committed to paying Florida at least $500 million annually, totaling $2.5 billion over the first five years with projections reaching $6 billion through 2030.

The compact made Florida one of the largest sports gambling markets in America, with the Hard Rock Bet app operated by the Seminoles serving as the sole legal platform for online sports wagering. This monopoly model stands in stark contrast to competitive markets in states like New York, New Jersey, and Pennsylvania, where multiple sportsbook operators vie for customers through aggressive marketing and promotional offers.

DeSantis defended the deal primarily on fiscal grounds, emphasizing the massive revenue stream it would create without requiring tax increases. State Senator Travis Hutson explained that the revenue could be used “to plug budget holes or to work on education or health or more resiliency or more septic to sewer or making our beaches ready for hurricanes.” For DeSantis, who built his political brand on fiscal conservatism, generating billions in new revenue while maintaining pro-business credentials represented an attractive political achievement.

The compact required approval from the Florida Legislature, which held a special session in May 2021 specifically to ratify the agreement. The Florida Senate voted 38-1 in favor, with Senator Jeff Brandes casting the sole dissenting vote, arguing against creating “a statewide monopoly for one entity for money” and noting it didn’t “conform to our Republican values that we are for free markets and open competition.” The House subsequently approved the deal, sending it to the federal Department of Interior for final approval under the Indian Gaming Regulatory Act.

The Legal Battles: Amendment 3 and Constitutional Questions

DeSantis’s gambling compact immediately faced legal challenges centered on Amendment 3, a 2018 Florida constitutional amendment requiring voter approval for any expansion of casino gambling in the state. Anti-gambling groups and some pari-mutuel operators argued that legalizing sports betting constituted a gambling expansion that required a statewide referendum.

The central legal question involved whether online sports placed through the Hard Rock app while physically located off tribal lands violated Amendment 3. The compact’s structure attempted to address this by having all bets processed through computer servers located on tribal property, with supporters arguing this meant sports gambling occurred on tribal lands regardless of where the bettor was physically located.

In November 2021, a federal judge struck down the compact, ruling it violated the Indian Gaming Regulatory Act because it permitted gambling on non-tribal lands. This decision temporarily shut down the Hard Rock Bet app just weeks after its initial November 2021 launch, leaving Florida without legal sports betting and threatening the revenue streams DeSantis had promised.

DeSantis acknowledged the legal risks when the ruling came down, stating “We anticipated that this could happen.” However, he defended including sports gambling in the compact by explaining the alternative was potentially worse: “I can only negotiate with the tribes. I cannot do any gambling outside of that per the amendment that passed in 2018.” DeSantis feared that without the compact, Florida would receive no revenue if sports betting was legalized through other means.

The Seminole Tribe appealed to the D.C. Circuit Court of Appeals, which ruled in their favor in June 2023. This ruling validated the compact’s legal structure and paved the way for sports betting to return to Florida. The Hard Rock Bet app relaunched to existing customers in November 2023 and opened to all eligible Florida residents in December 2023, finally delivering on DeSantis’s promise of legal sports bets.

In October 2023, the United States Supreme Court rejected an emergency bid to block the gambling compact, effectively ending federal legal challenges. This decision meant sports gambling could proceed in Florida, though Justice Brett Kavanaugh wrote separately questioning whether separate issues under state law might arise, making clear however that such concerns were not “squarely presented” in the current case.

DeSantis’s Rationale: Revenue Without Voter Approval

DeSantis’s most controversial decision was proceeding with sports legalization without putting it before voters despite Amendment 3’s requirements. His legal theory rested on two arguments: first, that sports bets didn’t constitute “casino gambling” as defined in the amendment; second, that tribal gaming compacts were explicitly exempted from Amendment 3’s voter approval requirement.

State lawyers in Attorney General Ashley Moody’s office argued that sports bets “is not ‘casino gambling’ as that term is defined in the Florida Constitution,” noting that “the types of games typically found in casinos was fixed at the time” the constitutional amendment passed and those games did not include sports betting.

Critics viewed this interpretation as sophistry designed to circumvent clear voter intent expressed in Amendment 3. John Stemberger, president of the Florida Family Policy Council, led social conservatives in opposing the deal. Stemberger organized rallies calling on the Legislature to reject gambling expansion, arguing “We do not want to be the destination casino state. We want to be what we are right now, the beautiful, family-friendly theme park state.”

However, DeSantis’s gamble paid off legally, with courts ultimately accepting his interpretation. This success emboldened his broader governance style of aggressively pursuing controversial policies without necessarily seeking explicit popular approval, confident that legal frameworks could be navigated successfully with skilled attorneys.

The Monopoly Model: Competitive Concerns

The most distinctive aspect of DeSantis’s sports policy is granting the Seminole Tribe exclusive control over online wagering. This monopoly model contrasts sharply with most other states where multiple apps compete for customers. DraftKings, FanDuel, BetMGM, and other major sportsbook operators cannot legally offer their platforms in Florida, giving Hard Rock Bet complete market dominance.

Senator Jeff Brandes argued this approach violated Republican principles, stating: “We have decided to create a statewide monopoly for one entity for money. That’s it. It isn’t the right thing to do. It doesn’t conform to our Republicans values that we are for free markets and open competition in the state of Florida.”

Free market advocates contend that monopolies harm consumers through reduced innovation, worse odds, inferior customer service, and fewer promotional offers. In competitive markets, sportsbook operators aggressively compete on bonus offers, user interface quality, odds quality, and betting options. Florida bettors lack these competitive benefits.

DeSantis defended the monopoly by emphasizing the revenue guarantees it provided. Competitive markets might generate more overall handle (total amount wagered) but potentially less tax revenue if operators offer aggressive promotions to gain market share. The Seminole compact’s guaranteed payments provided budget certainty that competitive markets couldn’t match.

The tribal sovereignty argument also justified the monopoly. Florida’s gaming landscape has long centered on Seminole casino operations, which provide critical economic support to the tribe. Allowing outside corporations to compete with tribal gaming operations could undermine this economic foundation. DeSantis positioned himself as protecting tribal interests while generating state revenue—a win-win narrative that deflected free market critiques.

Interestingly, recent reports suggest this monopoly might not be permanent. In October 2024, Hard Rock International Chairman Jim Allen indicated potential interest in partnering with top online sportsbooks like DraftKings and FanDuel. Such partnerships could introduce competition while maintaining the Seminoles’ controlling position, potentially representing a future evolution of Florida’s betting market.

Cracking Down on Illegal Gambling Operations

While legalizing sports betting through the Seminole compact, DeSantis simultaneously ramped up enforcement against illegal gambling operations throughout Florida. In his proposed 2025-26 budget, DeSantis requested $3 million in increased funding for the Florida Gaming Control Commission to investigate illegal gambling, including $748,000 for technology, $225,000 for additional staff, and $2.1 million for warehouse storage of seized equipment.

This dual approach—legalizing sports bets while cracking down on illegal gambling—reflects DeSantis’s pragmatic conservatism. Rather than attempting to prohibit all gambling (which he recognized as unenforceable), he channeled activity into regulated, taxed betting markets while aggressively prosecuting those operating outside legal frameworks.

Law enforcement officials testified before the Florida Legislature about challenges prosecuting illegal gambling operations. Jacksonville Sheriff’s Office Chief Ed Cayenne explained: “There is zero disincentive for these establishments to close down due to the misdemeanors that they face. They are willing to pay the fines and continue the operations because they are so profitable.” DeSantis’s funding increase aimed to address this enforcement gap by providing resources for sustained investigations and prosecutions.

This approach aligns with DeSantis’s broader law-and-order political brand. He positions himself as tough on crime while recognizing that smart regulation can be more effective than blanket prohibition. Legalizing sports betting reduces the illegal gambling market’s size while generating revenue to fund enforcement against remaining illegal operations—a policy feedback loop that DeSantis viewed as virtuous.

DeSantis’s 2024 Presidential Campaign and Gambling Policy

DeSantis’s presidential campaign, which ended in January 2024 after disappointing primary results, largely avoided emphasizing gambling policy. However, his Florida record on sports betting provided both opportunities and vulnerabilities had his campaign gained traction.

On one hand, DeSantis could tout his success in securing billions in new revenue without tax increases, appealing to fiscal conservatives who prioritize balanced budgets. The Seminole compact demonstrated his ability to negotiate complex deals, navigate legal challenges, and deliver results—core competencies for presidential leadership.

On the other hand, the monopoly model and Amendment 3 controversy created openings for attacks. Primary opponents might have criticized him for creating anti-competitive markets, circumventing voter approval requirements, or expanding gambling despite conservative values voters’ concerns. His willingness to partner with the Seminole Tribe could have been framed either as respecting tribal sovereignty or as granting special favors to politically connected interests.

Had DeSantis faced off against Donald Trump in a sustained primary battle, their different approaches to gambling regulation might have provided contrast. Trump’s casino background and more permissive attitude toward industry expansion differed from DeSantis’s controlled monopoly model. However, DeSantis’s campaign collapsed before these differences became significant political issues.

The Betting Industry’s View of DeSantis

The industry’s assessment of DeSantis is mixed. The Seminole Tribe obviously views him favorably, having secured an extraordinarily valuable 30-year monopoly on Florida sports bets. The compact represents the tribe’s most significant economic victory in decades, cementing their position as one of America’s most successful tribal gaming operations.

However, major sportsbook operators like DraftKings, FanDuel, and BetMGM view DeSantis’s monopoly model unfavorably. These companies invested billions developing betting apps and competing for market share in other states, only to be locked out of Florida—one of America’s largest potential markets. They’ve lobbied for opening Florida to competition, but DeSantis has shown no indication of changing course.

Gambling regulation experts hold varied opinions on DeSantis’s approach. Some praise the revenue certainty and simplified oversight that monopoly provides, arguing that competitive markets create race-to-the-bottom dynamics where operators cut corners on responsible gambling to maximize profits. Others criticize the anti-competitive aspects, arguing consumers deserve choices and that competition drives innovation benefiting bettors.

Sports leagues have generally adapted to Florida’s model without major complaints. The NFL, NBA, MLB, and others recognize that Florida’s large population generates significant gambling handle regardless of monopoly vs. competitive structure. League concerns about betting corruption, game integrity, and athlete protection apply equally across different market structures.

Responsible Gambling Under DeSantis

One area where DeSantis’s record remains somewhat opaque involves responsible gambling protections and problem gambling treatment. While the Seminole compact generates massive revenue for Florida, the allocation of funds specifically for gambling addiction treatment and prevention hasn’t received the same attention as headline revenue figures.

Some states with legal sports betting dedicate substantial portions of tax revenue to problem gambling programs, addiction treatment, and public education about risks. Others allocate minimal funding, leaving treatment infrastructure underdeveloped even as sports wagering expands rapidly.

DeSantis hasn’t made responsible gambling a signature issue, focusing instead on fiscal benefits and tribal partnership aspects of the compact. This silence might reflect political calculation—emphasizing gambling addiction risks could undermine support for the revenue-generating compact. However, it creates vulnerabilities if problem gambling rates spike in Florida following sports betting legalization.

The Hard Rock Bet platform includes standard responsible gambling features like deposit limits, self-exclusion options, and links to gambling addiction resources. However, whether these voluntary tools adequately protect vulnerable populations remains debatable. More aggressive interventions—mandatory betting limits, required cooling-off periods, enhanced age verification—haven’t been emphasized in DeSantis’s gambling policy.

As Florida accumulates more years of data on sports betting impacts, pressure may mount for enhanced responsible gambling protections. DeSantis or his successors will need to decide whether Florida’s monopoly model creates opportunities for stronger consumer protections or whether the compact’s structure limits regulatory flexibility.

The Broader Florida Gambling Ecosystem

DeSantis’s sports betting compact existed within broader gambling regulation changes. The 2021 legislation also created a five-member Florida Gaming Control Commission appointed by the governor and confirmed by the Senate, centralizing gambling oversight under clearer authority structure.

Additionally, DeSantis signed legislation allowing pari-mutuel operators to drop harness racing, quarter-horse racing and jai alai requirements while keeping more lucrative card rooms, effectively ending much of Florida’s traditional racing industry. This “decoupling” reform eliminated outdated requirements that forced facilities to operate unprofitable racing operations to maintain profitable card rooms.

These changes demonstrate DeSantis’s willingness to comprehensively restructure Florida’s gambling industry rather than tinker at the margins. He recognized that Florida’s pre-2021 gambling landscape reflected decades of piecemeal changes and interest-group compromises rather than coherent policy design. The 2021 reforms swept away much of this accumulated complexity, replacing it with a simpler structure centered on Seminole gaming operations.

This comprehensive approach aligns with DeSantis’s governing style in other policy areas—pursuing ambitious reforms rather than incremental adjustments. Whether on education policy, COVID-19 responses, or cultural issues, DeSantis demonstrates preference for bold action over cautious moderation.

DeSantis’s Future Political Trajectory and Betting Policy

While DeSantis’s 2024 presidential campaign fell short, he remains a young politician with decades of potential influence ahead. Whether he runs for president again in 2028 or beyond, serves in future Republican administrations, or completes his time as Florida governor before moving to private sector, his sports betting legacy will continue shaping national debates about gambling regulation.

If competitive sportsbook operators eventually gain Florida market access, it could validate criticisms of DeSantis’s monopoly model while demonstrating political evolution. If the monopoly persists and thrives, it might inspire other states to pursue similar arrangements, particularly those with significant tribal gaming operations.

DeSantis’s success in navigating complex legal challenges around the Seminole compact enhanced his reputation for political effectiveness. Critics argued the compact violated clear constitutional requirements, but DeSantis’s legal team successfully defended it through multiple court challenges. This demonstrated his administration’s competence in achieving controversial policy goals through sophisticated legal strategies.

Conclusion: A Distinctive Model for Legal Sports Betting

Ron DeSantis’s approach to sports betting legalization represents one of America’s most distinctive gambling regulation models. By granting the Seminole Tribe a 30-year monopoly over online wagering, he created a structure fundamentally different from competitive betting markets in most other states. This choice generated massive guaranteed revenue while protecting tribal gaming interests, though at the cost of market competition and consumer choice.

DeSantis’s success in pushing through this controversial compact despite legal challenges, political opposition, and free-market critiques demonstrates his political skill and willingness to pursue ambitious policies despite uncertainty. Whether his monopoly model represents wise policy or missed opportunity for better serving Florida consumers and the betting industry remains debated.