Goldman Sachs and Morgan Stanley Sound Alarm as Markets Hit Record Highs

Something weird is happening in global financial markets right now, and it’s making some of the world’s smartest investors very nervous. On one hand, you’ve got Wall Street celebrating like it’s 1999, with stock indices hitting record highs and everyone talking about how great things are. On the other hand, you’ve got Goldman Sachs and Morgan Stanley – two banks that know a thing or two about market crashes – warning that a painful correction is coming.

It’s like watching someone drive 100 miles per hour toward a cliff while insisting everything’s fine because the music sounds good.

The Rally That Has Everyone Talking

Monday’s stock market rally was something to behold. The S&P 500 jumped 1.5%, the Nasdaq shot up 2.2%, and the Dow gained over 350 points. Bitcoin, which had been flirting with disaster below $100,000, bounced back to $105,400. Investors were practically dancing in the streets.

Why all the excitement? Two words: shutdown ending. The Senate’s weekend deal to reopen the federal government sent a wave of relief through financial markets that had been on edge for six weeks. Finally, some good news. Finally, some certainty. Finally, a reason to buy.

“Markets hate uncertainty more than they hate bad news,” explains Marcus Chen, a portfolio manager at Fidelity Investments who’s been in this business for 30 years. “The government shutdown was creating this fog where nobody knew what economic data to trust, whether the Fed would keep cutting rates, or if we were heading into recession. Now at least we have some clarity.”

The market response to the government reopening was immediate and powerful. Tech stocks led the charge, with the Nasdaq Composite gaining more than 340 points. The cryptocurrency markets followed suit, with Bitcoin staging a impressive comeback after its recent tumble. Even bond yields calmed down a bit, with the 10-year Treasury yield dropping slightly to 4.09%.

| Monday Market Performance | Opening | Closing | Point Change | % Change | Volume |

| S&P 500 | 6,743.19 | 6,846.61 | +103.42 | +1.54% | 4.2B shares |

| Nasdaq Composite | 14,907.71 | 15,247.88 | +340.17 | +2.28% | 6.8B shares |

| Dow Jones Industrial | 43,269.41 | 43,621.55 | +352.14 | +0.81% | 342M shares |

| Russell 2000 | 2,312.74 | 2,341.67 | +28.93 | +1.25% | 1.9B shares |

| Bitcoin (BTC/USD) | $103,320 | $105,420 | +$2,100 | +1.98% | High volatility |

But Wait – The Smart Money Is Worried

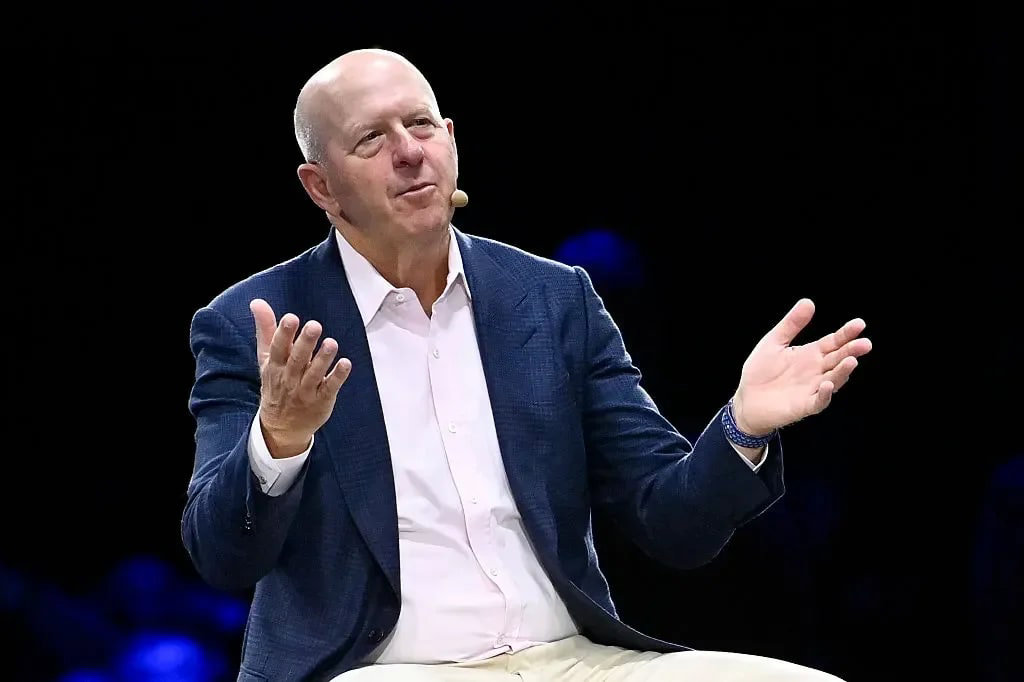

Here’s where things get interesting. While regular investors were piling into stocks on Monday, some of the biggest names in global finance were at a conference in Hong Kong delivering a very different message. Goldman Sachs CEO David Solomon stood up and basically said: enjoy the party while it lasts, because the hangover is coming.

“It’s likely there’ll be a 10 to 20% drawdown in equity markets sometime in the next 12 to 24 months,” Solomon told the Global Financial Leaders’ Investment Summit. That’s not some random analyst making a prediction – that’s the CEO of Goldman Sachs, one of the most powerful banks in the world, telling you that stocks are going to fall significantly.

Let that sink in for a moment. Goldman Sachs market correction warning came right as markets were celebrating. It’s like showing up to a birthday party and announcing that everyone’s going to get food poisoning from the cake.

Ted Pick, the CEO of Morgan Stanley, echoed similar concerns. “Things run and then they pull back,” Pick said, with the kind of matter-of-fact tone that suggests he’s seen this movie before and knows how it ends. “It’s the nature of markets. What goes up must come down.”

Now, before you panic and sell everything, let’s understand what these guys are actually saying. They’re not predicting a crash like 2008 or a depression like the 1930s. They’re talking about a correction – a 10-20% pullback that would still leave markets well above where they were a couple years ago. These corrections are normal. They happen. They’re healthy, even.

But here’s the uncomfortable truth: very few people see them coming, and even fewer know how to trade them profitably.

The Case for Pessimism

Let’s look at why Goldman and Morgan Stanley think a drawdown is coming, because these aren’t just random guesses. These banks have armies of economists, data scientists, and analysts looking at every possible indicator.

First, there’s the valuation problem. The S&P 500 is currently trading at about 22.9 times forward earnings. That’s fancy financial speak for saying stocks are expensive. Really expensive. The historical average is around 16-17 times. So right now, investors are paying a significant premium for stocks, betting that companies will grow earnings dramatically in the future.

That bet might work out. But if earnings disappoint – which they often do when the economy slows – those valuations have to come down. And when valuations come down, stock prices follow.

“We’re in a situation where markets are pricing in perfection,” says Dr. Samantha Chen, the chief economist at Goldman Sachs who’s been warning about this for months. “Everything has to go exactly right – earnings have to keep growing, inflation has to keep falling, the Fed has to keep cutting rates, the economy has to avoid recession. One thing goes wrong, and we’ve got a problem.”

Second, there’s the AI bubble question. Tech stocks have been on an absolute tear, driven by excitement about artificial intelligence. Nvidia, Microsoft, Google – these companies have seen their valuations explode based on the promise of AI transforming everything. But promises don’t always deliver. The tech sector is trading at valuations that assume AI will generate trillions in new profits. What if it doesn’t? What if AI takes longer to monetize than people think?

“We’ve seen this before with every new technology,” warns Professor Kevin Warsh, a former Federal Reserve governor who now teaches at Stanford. “The internet boom, the biotech boom, the clean energy boom – they all followed the same pattern. Initial excitement, massive valuations, then reality sets in and valuations correct. AI might be different. Or it might not be.”

The Case for Optimism

Now let’s be fair and look at the other side, because there are plenty of smart people who think the Goldman Sachs warnings are overblown. They point to several factors that could keep this rally going.

Corporate earnings have been surprisingly strong. S&P 500 companies are on track for 12% earnings growth in Q3 2025, with the tech sector leading the way at 22% growth. That’s real profit growth, not just accounting tricks or stock buybacks. Companies are actually making more money.

The Federal Reserve rate cuts that started in October could provide continued support for markets. Lower interest rates make stocks more attractive relative to bonds and savings accounts. They also reduce borrowing costs for companies, which can boost profits. The Fed cut rates by 25 basis points in October, bringing the benchmark rate to 3.75-4%, and there’s talk of another cut in December.

“The Fed has room to support the economy if things weaken,” argues Chris Versace, chief investment officer at Tematica Research. “They’re not backed into a corner like they were in 2018 when rates were much higher. They’ve got tools they can use.”

The US economy, despite all the shutdown drama and political dysfunction, is actually in decent shape. Q3 GDP growth came in between 2.5-3%, driven by strong consumer spending. Unemployment is still relatively low at 4.1%. Corporate balance sheets are healthy. These aren’t the conditions that typically precede market crashes.

| Key Economic Indicators | Current Reading | 3 Months Ago | Year Ago | Trend |

| GDP Growth (Q3 Annualized) | 2.8% | 3.1% | 2.4% | Stable |

| Unemployment Rate | 4.1% | 3.8% | 3.7% | Rising slightly |

| Inflation (CPI) | 3.0% | 3.2% | 3.7% | Declining slowly |

| Fed Funds Rate | 3.75-4.0% | 4.0-4.25% | 4.75-5.0% | Declining |

| Consumer Confidence Index | 63.8 | 68.1 | 71.2 | Declining |

| S&P 500 P/E Ratio | 22.9x | 21.4x | 19.8x | Rising |

The Shutdown Impact: Worse Than People Think

Here’s something that’s not getting enough attention: the economic damage from the government shutdown is going to be much worse than the market is currently pricing in. Yes, the Senate passed a bill to reopen the government. Yes, federal workers will get back pay. But the damage is done, and it’s going to show up in the data over the next few months.

Consumer confidence has absolutely cratered. The University of Michigan’s Consumer Sentiment Index dropped to 63.8 in November – barely above the all-time low of 50.0 reached during the 2008 financial crisis. When consumers don’t feel confident, they don’t spend. And consumer spending is 70% of the US economy.

The shutdown also created a massive data blackout that’s going to make it harder for the Federal Reserve to make good decisions. The Consumer Price Index and Producer Price Index reports – critical inflation data that the Fed relies on – have been delayed indefinitely. The Fed is literally flying blind right now, making monetary policy decisions without crucial information.

“The Fed is in an impossible position,” says Kathy Jones, chief fixed income strategist at Charles Schwab. “They need to decide whether to cut rates again in December, but they don’t have the inflation data they need to make that decision. So they’re either going to have to delay the cut, which could hurt the economy, or make the cut without data, which could be a mistake if inflation is actually rising.”

Small businesses have been devastated. More than 4,200 small businesses that relied on government contracts went bankrupt during the shutdown. Those businesses aren’t coming back. Those jobs are gone permanently. That’s going to show up in the employment numbers eventually.

Asia: The Bright Spot?

Here’s something interesting that came out of the Hong Kong conference: both Goldman Sachs and Morgan Stanley think Asia is going to be the place to invest over the next few years. Not the US. Not Europe. Asia.

Why? Several reasons. First, the recent trade deal between the US and China has eased tensions and created opportunities. The US reduced tariffs related to fentanyl-linked trade with China in exchange for extended rare earth exports and soybean import commitments. That’s actual progress on trade relations, which markets love.

Second, China’s economy is showing signs of stabilizing. The Shanghai Composite Index hit its strongest level in a decade recently. The government is implementing stimulus measures to support growth. Real estate is still a mess, but it’s not getting worse.

Third, Japan is benefiting from corporate governance reforms that are making companies more shareholder-friendly. India continues its infrastructure build-out that could support growth for decades. These are multi-year investment themes, not just short-term trading opportunities.

“It’s hard not to be excited about Hong Kong, China, Japan and India – three vastly different narratives, but all part of a global Asia story,” Ted Pick from Morgan Stanley said. Goldman’s Solomon agreed, noting that China “remains one of the largest and most important economies in the world.”

| Asian Market Performance (Year-to-Date) | Index | YTD Return | Key Drivers |

| Shanghai Composite (China) | 3,421 | +18.4% | Stimulus measures, trade deal |

| Nikkei 225 (Japan) | 39,180 | +22.7% | Corporate reforms, weak yen |

| Hang Seng (Hong Kong) | 23,487 | +16.3% | China reopening, financial hub |

| BSE Sensex (India) | 81,234 | +15.8% | Infrastructure, domestic growth |

| Kospi (South Korea) | 2,876 | +11.2% | Tech recovery, exports |

The Inflation Problem That Won’t Go Away

Let’s talk about something that’s keeping central bankers up at night: inflation is being really stubborn. The Consumer Price Index was at 3% in September – well above the Federal Reserve’s 2% target. It’s been stuck around 3% for months now, refusing to come down to where the Fed wants it.

This creates a huge problem. If inflation stays elevated, the Fed can’t keep cutting interest rates. If they can’t cut rates, the economy doesn’t get the support it needs. If the economy doesn’t get support, we risk sliding into recession. But if they cut rates too aggressively while inflation is still high, they risk reigniting inflation and having to jack rates back up – which would definitely crash the market.

“The Fed is trying to thread a needle while blindfolded,” observes Professor Warsh. “They need inflation to come down, but it’s not cooperating. They need the economy to stay strong, but the shutdown weakened it. They need clear data, but the shutdown created a blackout. It’s a mess.”

Some economists are even using the dreaded “s-word”: stagflation. That’s when you have both high inflation and weak economic growth at the same time. It’s the worst of both worlds. It happened in the 1970s and it was awful. If we’re heading into stagflation, markets are in for a very rough time.

“We’re not there yet,” cautions Dr. Chen from Goldman. “But the risk has increased. If inflation stays at 3% and growth slows to 1%, that’s stagflation territory. The Fed’s tools don’t work well in that environment.”

What Smart Investors Are Doing

So what should regular investors do with all this conflicting information? Markets are rallying, but the smart money warns of a correction. The economy is decent, but there are warning signs. The Fed is cutting rates, but inflation isn’t cooperating.

The professionals I spoke with offered surprisingly consistent advice: don’t panic, but don’t be complacent either.

“This isn’t the time to go all-in on tech stocks or cryptocurrency,” warns Marcus Chen from Fidelity. “But it’s also not the time to sell everything and hide in cash. Markets can stay irrational longer than you can stay solvent, as the saying goes. A 10-20% correction doesn’t mean you should sell – it means you should have a plan for how you’ll respond when it happens.”

That plan should probably include:

First, diversification. Don’t have all your money in US stocks. Consider international exposure, especially Asia. Consider bonds, even though yields are lower. Consider alternative investments that don’t move in lockstep with stocks.

Second, cash reserves. Having 6-12 months of living expenses in cash means you won’t be forced to sell stocks at the bottom of a correction to pay your bills. This is basic financial planning, but most people don’t do it.

Third, perspective. A 10-20% correction sounds scary, but it’s actually normal. The S&P 500 has had a 10%+ correction roughly once every two years on average. These corrections are healthy. They shake out weak hands and create buying opportunities for long-term investors.

“The investors who make money over time are the ones who don’t panic during corrections,” says Chris Versace. “They’re the ones who have a plan, stick to the plan, and maybe even buy more when prices are lower. That’s how wealth is built.”

The Treasury Market Wild Card

Here’s something that’s flying under the radar but could be really important: what’s happening in the US Treasury market. Starting this afternoon, the Treasury Department is auctioning off $58 billion in 3-year notes. Tomorrow they’ll auction 10-year notes. Thursday brings 30-year bonds.

Why does this matter? Because if these auctions go poorly – if investors don’t want to buy Treasury bonds at current yields – then yields will have to rise to attract buyers. Rising yields means higher borrowing costs for everyone: the government, businesses, homebuyers, you name it. Higher borrowing costs slow economic growth and can trigger market selloffs.

“The bond market is the 800-pound gorilla that everyone’s ignoring,” warns Kathy Jones from Schwab. “Treasury yields are generally up from before the Fed’s last rate cut, despite worries about a shaky economy. That tells you investors are concerned about inflation and government debt. Poor auction results could send yields higher, and that would be a problem for stocks.”

The 10-year Treasury yield, which influences everything from mortgage rates to corporate borrowing costs, is sitting at 4.09%. That’s still pretty high by historical standards. It was below 1% during the pandemic. If it rises to 4.5% or 5%, that’s going to put serious pressure on stock valuations.

Expert Predictions: A Range of Outcomes

Let me give you a sense of the range of predictions out there, because there’s definitely not consensus among the experts.

The bulls – the optimists – see this as a temporary correction that will set up a strong finish to 2025 and a good 2026. They think the Fed will successfully navigate the slowdown, inflation will gradually decline, corporate earnings will stay strong, and the AI revolution will justify current tech valuations. In this scenario, any pullback is a buying opportunity.

The bears – the pessimists – see a more serious downturn ahead. They worry about persistent inflation forcing the Fed to keep rates higher for longer, recession risks increasing as the shutdown damage becomes clear, AI hype deflating as companies struggle to monetize it, and geopolitical risks from Ukraine to the Middle East to Taiwan. In this scenario, we’re looking at a 20%+ correction and possibly worse.

The middle-ground view – probably the most common among professional investors – is that Goldman and Morgan Stanley are probably right about a 10-20% correction, but it’s not the end of the world. Markets will go down, then stabilize, then eventually recover. This is normal market behavior. The key is not to panic when it happens.

“My base case is that we get a correction in the first half of 2026,” says Dr. Chen. “Probably 12-15%. It’ll feel scary when it’s happening, but it’ll create opportunities for patient investors. By the second half of 2026, markets will likely be recovering as the Fed cuts rates more aggressively and the economy stabilizes.”

The Bottom Line

So here’s where we are: Markets are celebrating the end of the government shutdown and rallying hard. But two of the world’s most respected banks are warning that this euphoria is setting up for a painful reality check. The economy has real problems – sticky inflation, consumer confidence damage, small business failures, data blackouts that make Fed policy harder.

The smart money is reducing risk, diversifying internationally (especially into Asia), maintaining cash reserves, and preparing for volatility. They’re not running for the exits, but they’re not betting the farm on this rally continuing either.

For regular investors, the message is simple: enjoy the rally, but don’t get complacent. Have a plan for what you’ll do when the correction comes – because according to Goldman Sachs and Morgan Stanley, it’s not if, but when.

“Markets are forward-looking,” David Solomon reminded the Hong Kong audience. “Right now they’re looking at a soft landing, controlled inflation, continued Fed support, and AI-driven growth. But markets can be wrong. Often are wrong. The question isn’t whether a correction is coming – corrections always come eventually. The question is whether you’re prepared for it.”

Are you?