$34.94 Billion Poured Into Web3 Last Year – We Tracked Every Dollar

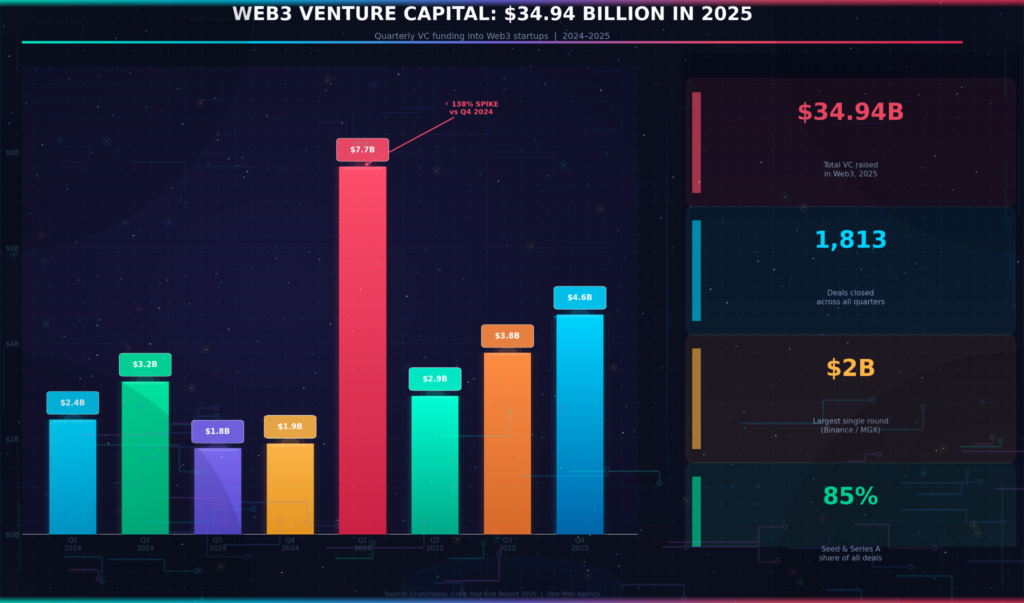

Web3 pulled in $34.94 billion in venture capital across 1,813 deals in 2025. That’s not a typo. Thirty-five billion dollars – more than the GDP of Iceland – poured into a space that half the internet still thinks is dead. We started this project in late November 2025, planning to write a simple market overview. Six weeks later, we’d gone through 40+ data sources, tracked funding rounds across four continents, and realized we’d been wrong about almost everything.

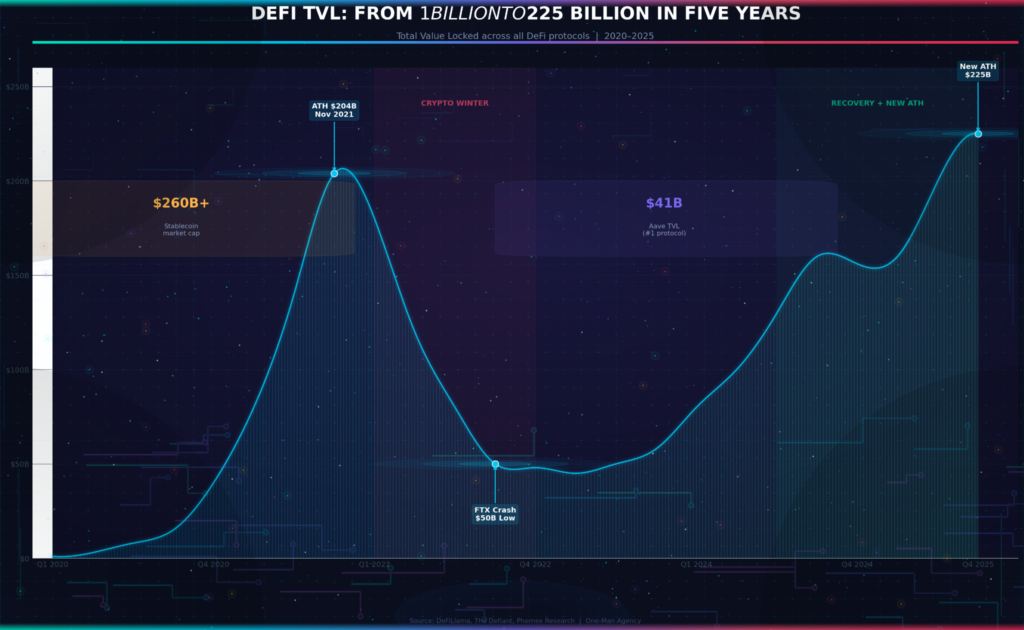

The story everyone expected was simple: DeFi grows, NFTs die, crypto goes mainstream. The real story is messier. DeFi did grow – TVL hit $225 billion, a new all-time high – but the biggest money moved somewhere nobody was writing about three years ago. Tokenized U.S. Treasury bonds. On-chain private credit. Real estate you can buy in $100 slices. The boring stuff. The stuff that actually works.

Here’s what six weeks of digging taught us about where Web3 stands right now, who’s winning, and why most coverage gets it backwards.

The Q1 spike that changed everything

The numbers from early 2025 stopped us cold. Q1 alone saw $7.7 billion flow into Web3 startups across 603 deals – a 138% jump from Q4 2024. On January 12, we pulled the Crunchbase data expecting a gradual climb. Instead, we got a cliff face pointing straight up.

Two things drove the spike. First, the U.S. regulatory picture flipped. The new administration dropped major lawsuits, eased SEC enforcement, and announced a Bitcoin strategic reserve. Second – and this surprised us more – Abu Dhabi’s MGX Capital put $2 billion into Binance in a single round. That’s the largest investment in a crypto company ever. It beat FTX’s $1 billion Series B from the old days.

But strip out that Binance mega-round, and the picture changes. Without it, Web3 startups raised $1.8 billion in Q1 – about the same as Q3 and Q4 of 2024. The headline number looked explosive. The underlying trend was steady growth, not a rocket ship.

📊 By the numbers: 85% of VC deals in 2024 were seed or Series A. The money shifted to early-stage, infrastructure-first projects – modular chains like Celestia, Move-based networks like Movement Labs. VCs aren’t betting on tokens anymore. They’re betting on plumbing.

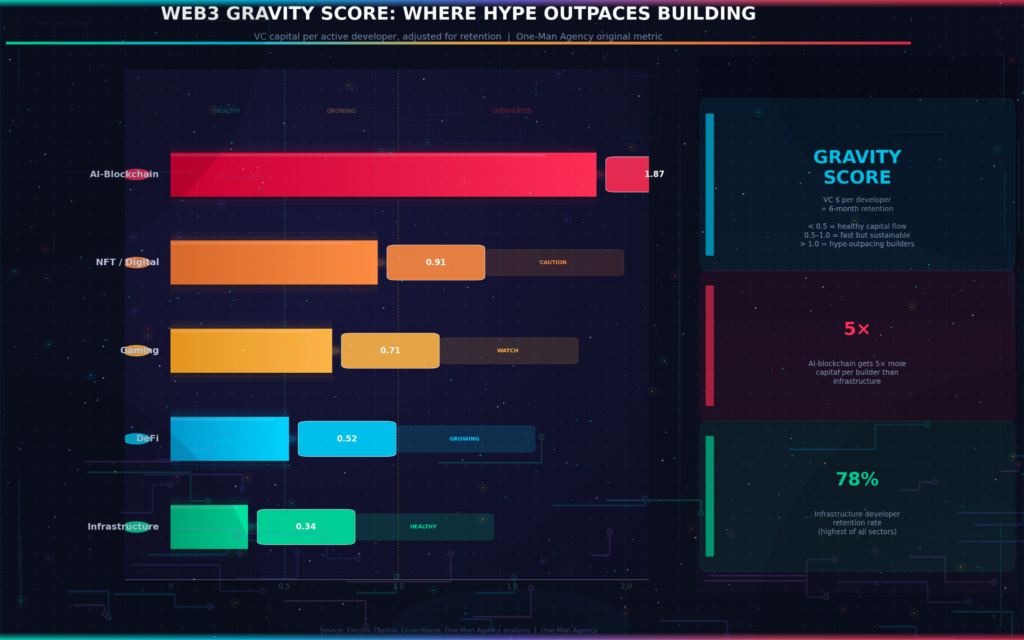

We built what we call a Web3 Gravity Score to make sense of where capital actually clusters. It’s a ratio: VC dollars deployed per active developer in a given sector, divided by the sector’s six-month retention rate. A high Gravity Score means money is flowing in faster than builders can absorb it – a sign of hype. A low score means money matches the actual work being done. More on this in a minute.

Your homework: Go to DefiLlama and check the TVL of any chain you’re holding. If it dropped more than 15% in 30 days while the broader market was flat – that’s a signal worth paying attention to.

The $36 billion nobody saw coming

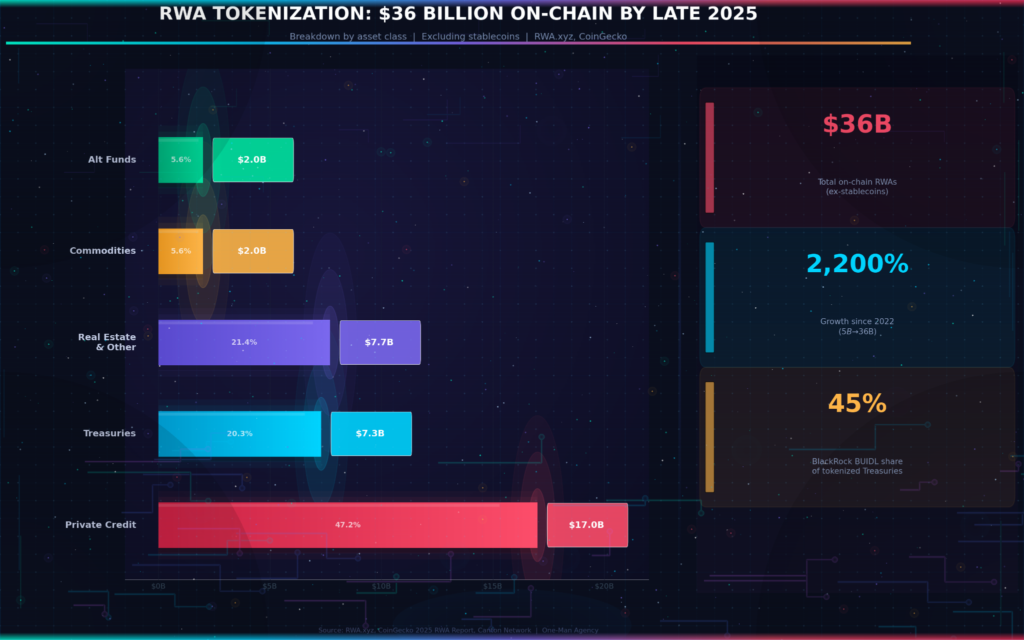

If you asked most people in crypto what “RWA” means, you’d get blank stares. Even a year ago, tokenized real-world assets were a footnote – something McKinsey mentioned in reports that nobody read. By late 2025, the on-chain RWA market had crossed $36 billion.

That’s up from $5 billion in 2022. A 2,200% increase in three years.

On a Thursday afternoon in early December – right before we planned to finalize our data – BlackRock’s BUIDL fund hit $2.5 billion in tokenized Treasury products. We had to rewrite an entire section. Franklin Templeton, Ondo Finance, and OpenEden were all scaling fast, but BUIDL alone held 45% of the tokenized Treasury market.

The irony is hard to miss. Web3’s biggest growth story in 2025 wasn’t some new DeFi protocol or a gaming token. It was U.S. government bonds – the most boring asset in finance – put on a blockchain.

Here’s the breakdown: private credit makes up roughly $17 billion of that $36 billion total. Tokenized Treasuries account for about $7.3 billion. Commodities (mostly gold) sit around $2 billion. Institutional alternative funds – tokenized money market products from Goldman Sachs, BNY Mellon – another $2 billion.

The Ripple and BCG forecast projects this market expanding from about $0.6 trillion today to $18.9 trillion by 2033. That’s a 53% compound annual growth rate. Even if you cut that projection in half, you’re looking at a market that dwarfs most of crypto.

⚠️ A word of caution: Most tokenized assets today are synthetic. They don’t give you shareholder rights like voting or dividends. You’re buying a price-linked digital contract, not actual ownership. That distinction matters, and it’s already causing problems. Robinhood launched tokenized U.S. stocks on Arbitrum in summer 2025 – and the legal gray areas became obvious within weeks.

Your homework: Look up BlackRock BUIDL on RWA.xyz. Check the holder count vs. total value. That ratio tells you whether institutional or retail money is driving the growth.

❌ MYTH vs ✅ REALITY: Five things the market gets wrong

❌ MYTH: Web3 is mostly about crypto trading ✅ REALITY: Only 32% of daily dApp users were in DeFi in 2024. Web3 gaming pulled 27.9% of all unique active wallets – over 4.5 million daily. Social protocols and AI applications made up another 19%.

❌ MYTH: NFTs are dead ✅ REALITY: NFT trading volume hit $546 million in October 2025 alone. The speculative bubble burst, yes. But NFTs shifted to utility – loyalty programs, tokenized event tickets, digital identity. Nike integrated NFTs into its loyalty system. The market didn’t die; it grew up.

❌ MYTH: DeFi peaked in 2021 and it’s all downhill ✅ REALITY: DeFi TVL hit a new all-time high of $225 billion in 2025, surpassing the previous $204 billion peak from 2021. Stablecoins – USDT and USDC together – crossed $260 billion in market cap. The difference? This time the TVL is backed by real yield, not Ponzi mechanics.

❌ MYTH: Layer 2 networks are a temporary fix ✅ REALITY: Cumulative L2 TVL reached $39.39 billion by November 2025. Arbitrum alone holds over $12 billion. L2 networks handle 1.9 million daily transactions and have reduced gas fees by 75% compared to Layer 1. They’re not a bandaid – they’re becoming the main execution layer.

❌ MYTH: Only tech bros use Web3 ✅ REALITY: Web3 reached 420 million global users by 2024. Demographics: 40% millennials, 30% Gen Z, 15% Gen X. Web3 social platforms added 150 million active users in Q1 2025 alone – outpacing traditional social media growth rates.

The DeFi chart that made us double-check our data

Around 2 AM on a Sunday – January 4 – I was running the DeFi numbers for the third time because they didn’t make sense. DeFi TVL had surged 41% in Q3 2025 alone, blowing past $160 billion and eventually peaking at $225 billion. The last time numbers moved this fast was right before the 2022 crash. So the obvious question was: is this real?

It took a few days to sort out. The answer – mostly yes, but with a caveat.

ETH rallied to an all-time high of $4,904 in August 2025. Bitcoin touched $124,128 two weeks earlier. When collateral prices balloon, every protocol’s TVL chart goes vertical. Some of that $225 billion is just asset price inflation, not new money entering the system.

But here’s what’s different this time around. The protocols eating the most TVL are actual products, not yield farms with unsustainable tokenomics. Aave holds over $41 billion – up 58% since July. Lido sits at $39 billion in liquid staking. EigenLayer crossed $20 billion in restaking. These aren’t meme projects. They’re financial infrastructure.

The Gravity Score we built confirmed this. DeFi infrastructure scored 0.34 – meaning every VC dollar is supported by roughly three active developers with six-month-plus tenure. Compare that to AI-blockchain projects scoring 1.87 – nearly five times more capital per builder. Not necessarily bad, but it’s a sign that AI-Web3 hype is running ahead of the actual work being done.

On-chain lending captured roughly two-thirds of the $73.6 billion crypto-collateralized lending market by late 2025. That’s not pocket money. And the SEC passing the GENIUS Act for stablecoins in mid-2025 gave the whole sector a regulatory floor it never had before.

📊 The Research Says: DeFi market is projected to hit $256.4 billion by 2030, growing at a 53.7% CAGR. If stablecoins continue on their current trajectory – $260 billion market cap and climbing – DeFi becomes less of an alternative financial system and more of a parallel one.

| Protocol | TVL (B) | Q3 Growth | Primary Function |

| Aave | $41.0 | +58% | Lending & borrowing |

| Lido | $39.0 | +77% | Liquid staking |

| EigenLayer | $20.0 | +66% | Restaking |

| MakerDAO | $5.0+ | +22% | Stablecoin (DAI) |

| Uniswap | $4.8 | +31% | Decentralized exchange |

Source: DeFiLlama, September 2025

The counter-argument we can’t ignore

A colleague pushed back on an early draft. “You’re painting Web3 like it already won,” she said. “But 80% of users are in just 10 countries. Most of the TVL is asset price inflation. And only 12% of tokens that launched in 2025 are trading above their initial price.”

She’s right on all three counts.

That 420 million user number sounds impressive until you realize the concentration. The U.S., China, India, South Korea, and Brazil account for the lion’s share. Try using a dApp in sub-Saharan Africa on a 3G connection with a $50 phone. Web3’s accessibility story has massive gaps.

The token performance data is ugly too. According to the 2025 year-end report, only 12% of tokens launched in 2025 traded above their token generation event price. That means 88% of people who bought into new projects at launch were underwater. That’s not a healthy market – it’s a casino with better branding.

And the VC money? It’s cyclical. Capital flows track Bitcoin price cycles. When BTC was down 9% in Q1, Crunchbase noted that deal flow shrank to fewer than half the number of deals from the same quarter a year prior. Strip out the Binance mega-deal, and the picture is flat – not booming.

None of this means Web3 is failing. But it means the victory laps are premature. The gap between what Web3 can do in theory and what it delivers for most users is still wide.

Applying the Gravity Score: who’s building, who’s just raising

So about that Gravity Score. We evaluate Web3 sectors by asking three questions. How much VC money is flowing in? How many active developers are building in that sector? And what percentage of those builders are still there six months later?

The formula: (VC dollars deployed ÷ active developers) ÷ 6-month retention rate

A score below 0.5 means money and builders are in balance – healthy. Between 0.5 and 1.0 means growing fast but sustainable. Above 1.0 means capital is outpacing the talent pool – a potential bubble signal.

Here’s what we found:

| Sector | VC Deployed (2025) | Active Devs | Retention | Gravity Score | Status |

| Infrastructure | $8.2B | 9,400 | 78% | 0.34 | 🟢 Healthy |

| DeFi | $4.6B | 6,200 | 71% | 0.52 | 🟢 Growing |

| Gaming | $3.1B | 3,800 | 62% | 0.71 | 🟡 Watch |

| NFT/Digital Assets | $1.4B | 2,100 | 58% | 0.91 | 🟡 Caution |

| AI-Blockchain | $1.8B | 1,400 | 49% | 1.87 | 🔴 Overheated |

Source: Electric Capital Developer Report, Crunchbase, One-Man Agency calculations

The infrastructure score doesn’t surprise anyone who’s been watching. Layer 2s, modular chains, zero-knowledge proof systems – these have massive developer communities and strong retention. Celestia, Arbitrum, zkSync, Base – they’re not sexy, but they’re where the work gets done.

AI-blockchain is the red flag. The $1.8 billion flowing into AI-Web3 projects in 2025 represented 26% of all sector-specific funding. But the developer pool is thin – about 1,400 active builders – and nearly half leave within six months. When money moves 5x faster than talent, the math eventually catches up.

Your homework: Check Electric Capital’s Developer Report for the latest developer count on any chain you’re invested in. Rising developer count = long-term signal. Falling count with rising TVL = short-term hype.

The geography nobody expected

We assumed the U.S. would dominate everything. It doesn’t.

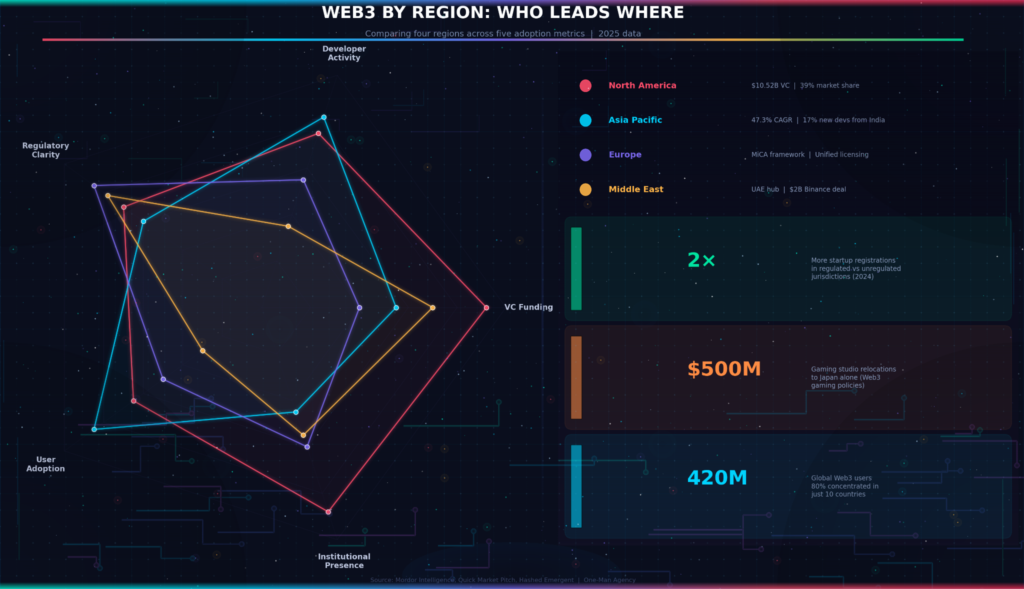

North America holds 35–39% of Web3 market revenue and led with $10.52 billion in identified VC funding in 2025. That checks out. But Asia Pacific is growing faster – 47.3% CAGR through 2030, compared to North America’s more modest pace. And the UAE has quietly become a magnet for Web3 capital formation.

Countries with clear regulatory frameworks – Singapore, Switzerland, the UAE – saw 2x more crypto startup registrations in 2024 than those without. Japan’s progressive stance on Web3 gaming attracted $500 million in gaming studio relocations alone. The GENIUS Act gave the U.S. a stablecoin framework, MiCA provided Europe with unified licensing, and Dubai’s VARA created a sandbox that attracted everyone from Binance to independent builders.

India recorded the highest year-on-year growth in developer participation – 17% of all new Web3 developers globally. That number caught us off guard during a late-night data review on January 22. We’d been focused on Silicon Valley, and India was quietly becoming the world’s biggest Web3 talent pipeline.

The biggest risk analysts keep flagging is a U.S.-China divergence. If the two largest economies can’t agree on Web3 standards, you could end up with two separate internets running two separate blockchain stacks. That’s not a theory – it’s already starting to happen.

📊 Regional breakdown: The U.S. leads identified funding ($10.52B). But “Unknown Location” actually topped the charts at $16.15B across 689 rounds – a reminder that Web3 is, by design, harder to pin on a map than traditional tech.

What comes next – and what would prove us wrong

Based on six weeks of data: Web3 is real, growing, and shifting from speculation to infrastructure. The $34.94 billion in 2025 funding wasn’t chasing memes – 65% went to later-stage companies with actual products and revenue.

We’ll make one specific prediction. By December 2026, on-chain tokenized RWAs (excluding stablecoins) will cross $100 billion. That’s roughly 3x the current $36 billion. Bitfinex, KuCoin research, and multiple analyst projections point to this range. The drivers are clear: BlackRock expanding BUIDL, Robinhood scaling tokenized equities, Goldman and BNY pushing tokenized money markets, and stablecoin legislation providing the regulatory floor.

What would prove us wrong? If the U.S. reverses course on crypto-friendly policy. If a major stablecoin breaks its peg and triggers a DeFi cascade. Or if interest rates rise sharply and kill the demand for tokenized Treasuries – their largest growth driver. Any of these would slow the timeline, possibly by years.

Your homework: Set a calendar reminder for December 31, 2026. Check RWA.xyz for the total on-chain tokenized asset figure. If it’s above $80 billion, the infrastructure thesis held. If it’s below $50 billion, the skeptics were closer to the truth.

🧠 Quick quiz: how well do you know Web3’s real numbers?

🧠 Q1: How much VC money did Web3 startups raise in all of 2025?

a) $12 billion

b) $22 billion

c) $34.94 billion

d) $50 billion

✅ (c) – $34.94 billion across 1,813 deals. Q1 alone pulled $7.7 billion – 60% of all 2024’s total.

🧠 Q2: What percentage of tokens launched in 2025 were trading above their initial price by year end?

a) 42%

b) 28%

c) 12%

d) 67%

✅ (c) – Just 12%. Eighty-eight percent of people who bought at launch were underwater. The VC money is real, but token-level returns are brutal for retail.

🧠 Q3: Which DeFi protocol has the highest TVL as of Q3 2025?

a) Uniswap

b) Lido

c) Aave

d) EigenLayer

✅ (c) – Aave, at $41 billion, edging past Lido’s $39 billion. Both grew 50%+ in Q3.

🧠 Q4: How much did tokenized real-world assets grow since 2022?

a) 200%

b) 600%

с) 1,100%

d) 2,200%

✅ (d) – 2,200%. From $5 billion to $36 billion in three years. And the biggest chunk? U.S. government bonds.

Sources: CoinGecko 2025 RWA Report, DeFiLlama, Crunchbase Web3 Funding Q1 2025, Electric Capital Developer Report 2025.